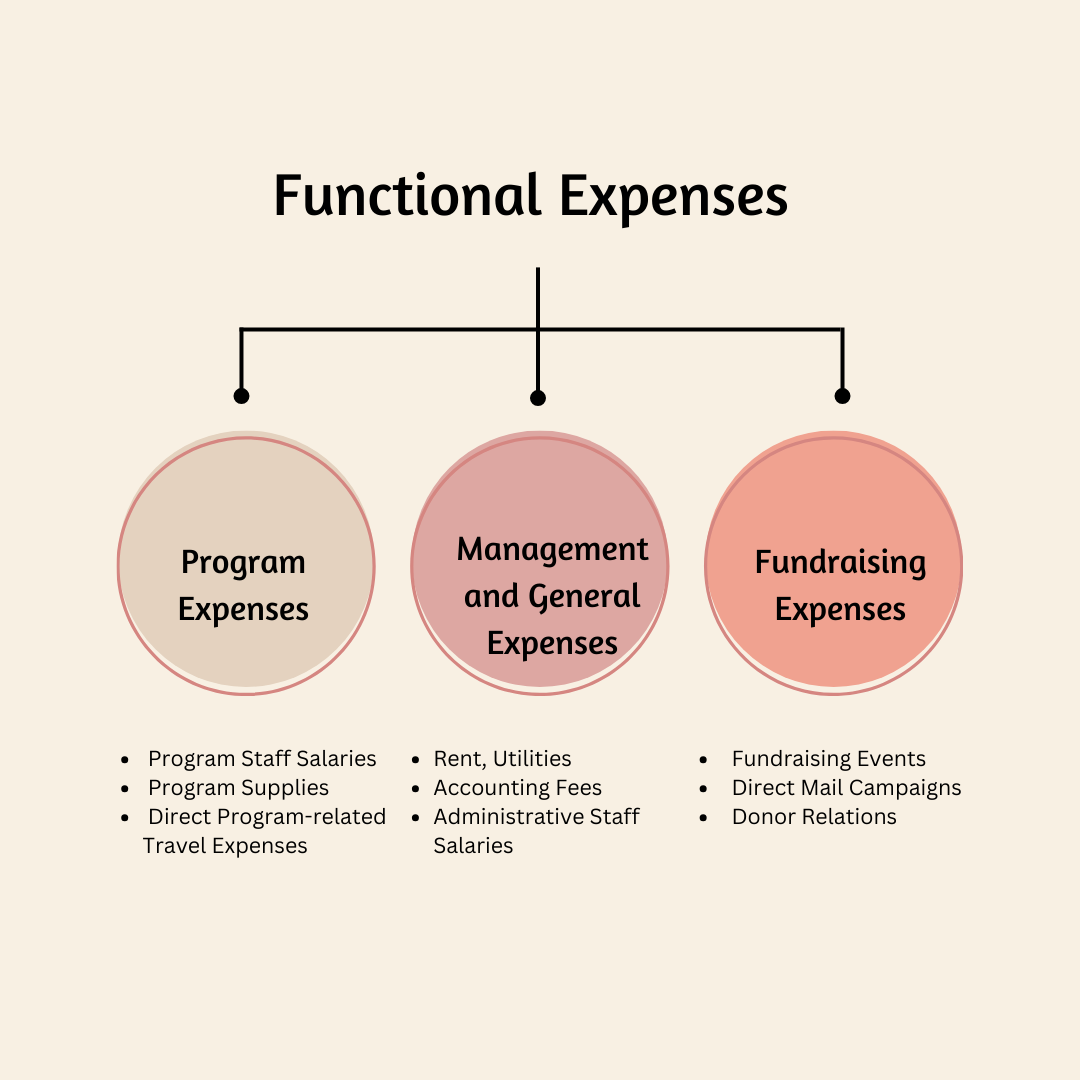

As you navigate the world of nonprofit finance, one critical concept to get a grip on is functional expenses. Let’s break down what this means and why it’s crucial for your organization.

What Are Functional Expenses?

Functional expenses categorize your organization’s spending into three main areas. This classification helps ensure transparency and accountability in how donor funds are utilized, which is vital for financial reporting and compliance with accounting standards. Here’s a closer look at each category:

1️⃣ Program Services Expenses

These are the costs directly tied to delivering your nonprofit’s mission-driven programs and services. Essentially, they represent the core of what your organization does. Here’s what falls under this category:

- Salaries and Benefits: Pay and perks for staff working directly on program activities.

- Program Supplies and Materials: Resources needed to execute your programs effectively.

- Direct Program-Related Travel: Expenses incurred while traveling for program-related purposes.

By tracking these expenses, you can clearly demonstrate to stakeholders how effectively you’re using resources to advance your mission.

2️⃣ Management and General Expenses

These are costs associated with the overall management and administration of your organization, which support all functions, including your programs. Key examples include:

- Salaries and Benefits: For executive and administrative staff.

- Office Rent and Utilities: Essential for maintaining a physical space.

- Insurance and Legal Fees: Ensuring compliance and protection.

- Office Supplies: General supplies needed for daily operations.

Properly allocating these expenses ensures that you account for the broader operational costs of running your nonprofit.

3️⃣ Fundraising Expenses

These expenses are linked to activities aimed at generating donations and financial support for your organization. They help keep the fundraising engine running smoothly. Consider these costs:

- Salaries and Benefits: For staff dedicated to fundraising efforts.

- Fundraising Events: Costs related to organizing and hosting events.

- Direct Mail Campaigns and Website Maintenance: Expenses for outreach efforts and maintaining fundraising infrastructure.

Understanding and categorizing these expenses helps you track the efficiency and effectiveness of your fundraising strategies.

Why It Matters

Accurately classifying expenses into these functional categories is more than just good practice—it’s essential for maintaining transparency and accountability. It shows donors, stakeholders, and regulators how well you manage resources and adhere to accounting standards.

In Summary:

- Program Services Expenses reflect your mission in action.

- Management and General Expenses cover the backbone of your operations.

- Fundraising Expenses track the costs of sustaining and growing your support base.

By breaking down and correctly allocating your expenses, you can provide a clear, transparent picture of your financial health and ensure compliance with regulatory requirements. This transparency not only builds trust with your donors but also strengthens your organization’s credibility and effectiveness.